Type 86 is not always the best solution for Section 321 Clearance. When the complexities of Entry Type 86 do not seem to fit because of the US HTS Code requirements dictate Partner Government Agencies (PGA) message Sets and the obligations in an ET86 ABI entry, there are other options.

The Air Express Clearance under Express Consignment Carrier & HUB Facility (ECCF/HUB) may be a better choice for applicable PGA’s.

Working with an experienced global logistics provider like IBC can help you determine the best means of clearance by evaluating Partner Government Agencies (PGA) Air Imports E-commerce clearances strategy methods and its simplicities under ECCF/HUB clearance. IBC offers the experience and expertise in providing full-service, in-house customs brokerage solutions customized to your needs.

In the demanding, fast paced world of Air e-commerce import clearance into the U.S., it’s become more of a specialized science in determining which clearance is best for your e-commerce shipment commodities.

There are two main methods of clearance for the Air e-commerce environment. These include:

- An Air Express Consignment Carrier/HUB Facility (ECCF/HUB) is the fastest and most efficient.

- An ACE ABI Entry Type 86 that is second to the ECCF/HUB method.

When it comes to PGA commodities that fall under the realm of the PGA scope (US FDA, USDA, APHIS, CPSC,…) the most economical and efficient way for some of the PGA products is the ECCF/HUB clearance.

For instance, if you have cosmetic products and meet all the labeling and FDA mandated requirements, and your e-commerce shipments are manifest for clearance under the ECCF/HUB method, you are not required to submit an FDA entry for review (provided it meets the De Minimis value of $800 USD or less threshold, as per US FDA). https://content.govdelivery.com/accounts/USDHSCBP/bulletins/1a74ba6

List of Exemptions

- Cosmetics

- Dinnerware (including eating and/or cooking utensils)

- Radiation emitting, non-medical devices (e.g. microwaves, televisions, CD players, etc.)

- Biological samples for laboratory testing

- Food, excluding ackees, puffer fish, raw clams, raw oysters, raw mussels, and foods packed in airtight containers intended to be stored at room temperature

Example: Clearance method as 2). ACE ABI Entry Type 86.

As an ET86 you must submit the full FDA/PGA entry data message sets and may be upwards of a hundreds data message sets, Customs Bond, US HTS Code, (IOR) Importer Of Record their IRS/EIN #. Or the Broker obligates themselves as the liable party to FDA. These are all not a viable choice of practice or an efficient clearance process. You might as well have made a formal ABI entry for clearance with the same information. Again, it’s not an economical choice or cost effective clearance method or means at all.

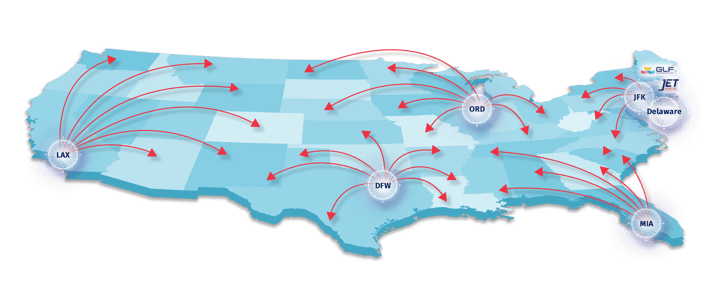

The obvious choice is with the ECCF/HUB clearance method, it's clean and simple. As the largest independent operator of ECCF/HUB’s in the USA, IBC is your solution for all of your e-commerce imports.

Border Interagency Executive Council (BIEC) offers a list of agencies that may allow clearance under Section 321 Express Courier Clearance ECCF / HUB.

Border Interagency Executive Council (BIEC) Guidance on Partner Government Agency (PGA) Policies Regarding

the Section 321 De Minimis Value Rule, Returned American Goods and Household and Personal Effects

Background

The Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA) includes an amendment of Section 321 of the Tariff Act of 1930 (19 U.S.C. § 1321) to increase the de minimis value exemption from the payment of duties and taxes from $200 to $800. Subject to certain limitations outlined in 19 CFR 10.151-10.153, U.S. Customs and Border Protection (CBP) shall pass free of duty and tax any eligible shipment of merchandise with a value not exceeding $800. Most Partner Government Agencies (PGAs) do not exempt shipments from their respective requirements based on the shipment’s value.

Accordingly, a shipment may benefit from CBP’s application of the section 321 duty and tax exemption, but the value exemption does not waive PGA requirements.

On September 28, 2019, CBP deployed the Entry Type 86 Test. This voluntary test allows customs brokers and self-filers to electronically submit de minimis value entries through ABI, including those subject to PGA data requirements for clearance without the payment of duties and taxes.

Filers are reminded that de minimis value shipments subject to PGA requirements must follow PGA guidance (provided in the following charts) to obtain clearance. Filers may continue to file Entry Type 11 entries to obtain clearance of PGA regulated merchandise; however, in such cases duties and taxes will apply. Shipments that are subject to agricultural fees are not permitted to be filed as an Entry Type 86 and must continue to be filed as an Entry Type 11.

In addition to implementation of TFTEA, and as reflected in the CBP E-Commerce Strategy, CBP and PGAs are adapting to an evolving business environment where e-commerce is the main driver of growth in low-value shipments. CBP is working closely with PGAs to strengthen compliance and facilitation of cross-border e-commerce.

PGA Policies related to the De Minimis Value Rule, Returned American Goods and Household and Personal Effects

- Chart 1 provides guidance on PGA policies related to Section 321 exemptions due to declared value.

- Chart 2 provides guidance regarding how to file PGA data in ACE using the new Entry Type 86 capability.

- Chart 3 provides guidance on PGA policies related to returned American goods or personal effects. PGAs have differing policies for handling shipments wholly of returned American goods or personal effects.

These charts were derived from input provided directly by the relevant PGAs, and are meant to serve as guidance only.

Please refer to each Partner Government Agency’s regulations for full details, and direct any inquiries to the relevant PGA as appropriate.

Chart 1 – PGA Policies Related to the Section 321 Exemption due to Declared Value

|

Agency (Department) |

Policy on Section 321 Exemption due to Declared Value |

|

No exemptions due to declared value. |

|

|

No exemptions due to declared value. |

|

|

A Lacey Act declaration is not required for de minimis shipments nor shipments under $2500. Formal entries require a Lacey Act declaration. |

|

|

ATF allows imports of minor components and parts for Category I(a) and I(b) firearms except barrels, cylinders, receivers (frames) or complete breech mechanisms, when the total value does not exceed $100 wholesale in any single transaction. |

|

|

No exemptions due to declared value. |

|

|

DOE OGC |

No exemptions due to declared value. |

|

No exemptions due to declared value. All products covered by antidumping/countervailing duty orders require a CBP formal entry. |

|

|

No exemptions due to declared value. However, the import of used ozone- depleting substances under 5 lbs. is exempt from the import petitions process. |

|

|

No exemptions due to declared value. |

|

|

No exemptions due to declared value. |

|

|

EPA TSCA |

No exemptions due to declared value. |

|

Cargo Systems Messaging System (CSMS) # 17-000388 outlines an exclusionary list of FDA-regulated product categories that qualify for release by CBP under the de minimis value threshold without requiring the submission of entry information to FDA for admissibility review. For those articles under the purview of FDA falling under the de minimis value threshold but for which FDA requires shipment information to make an admissibility determination (i.e. drugs, medical devices, tobacco, etc.), the requisite data for the product is required. FDA prefers to have the information submitted electronically, regardless of entry type. FDA’s prior notice requirements must continue to be met on all food and feed shipments regardless of value or quantity. Unless otherwise exempt from the prior notice requirements for one of the indicated reasons under 21 CFR 1.277(b), there are no exemptions based on a de minimis value or quantity of food. |

|

|

No exemptions due to declared value. |

|

|

No exemptions due to declared value. |

|

|

No exemptions due to declared value. |

|

|

No exemptions due to declared value. |

|

|

No exemptions due to declared value. |

Chart 2 – Process to File PGA Data in ACE on

De Minimis Value Shipments using the New Entry Type 86 Capability

Please Note: Use of Entry Type 86 is voluntary; filers that do not opt to use ET 86 may file Entry Type 01 or Entry Type 11 for goods subject to PGA requirements. Goods subject to PGA requirements should not be released from Manifest.

|

Agency (Department) |

PGA Policies |

|

All commodities regulated by AMS must be cleared via CBP ACE Message Set or directly with AMS via paper filing prior to entry regardless of value. If AMS inspection is required, entries will be directed to the nearest AMS Facility. |

|

|

APHIS regulations require submission of information at the first port of arrival. APHIS will accept formal, informal and entry type 86 submissions. For paper submission at the first port of arrival, the process will remain unchanged. |

|

|

Lacey does not require a Lacey Declaration for de minimis value shipments. |

|

|

For shipments of minor components and parts for Category I(a) and I(b) firearms except barrels, cylinders, receivers (frames) or complete breech mechanisms, when the total value exceeds $100 wholesale in any single transaction, the ATF PGA message set must be filed or the Form 6 and 6a must be presented in person at the port of entry. |

|

|

CPSC does not currently have additional data requirements above that of CBP. Therefore, no CPSC PGA Message Set data is required for de minimis value shipments. |

|

|

DOE OGC |

DOE does not currently have additional data requirements for de minimis value shipments. |

|

All products covered by antidumping/countervailing duty orders require a CBP formal entry; there are no exemptions due to value. |

|

|

CCA ODS does not require filing through ACE. For petitioned material over 5 pounds, the non-objection notice must accompany the shipment in ACE per 40 CFR 82.13(g)(3) and 82.24(c)(4). |

|

|

If filing in ACE and using ET86, importers should file the EPA PGA message set, otherwise importers of de minimis value shipments regulated under the CAA for V&E may file the appropriate paper 3520-1 or 3520-21 EPA declaration forms. |

|

|

If filing in ACE and using ET86, importers should file the EPA PGA message set; otherwise importers of de minimis value shipments regulated under FIFRA are required to submit a paper EPA Form 3540-1, Notice of Arrival of Pesticides and Devices (NOA), completed in full, to the EPA regional office having jurisdiction over the state/territory where the shipment is to arrive. |

|

|

If filing in ACE and using ET86, importers should file the EPA PGA message set, otherwise importers of de minimis value shipments regulated under TSCA are required to provide a written certification assuring that the chemical or mixture of chemicals within the shipment fully comply with TSCA, to CBP. |

|

|

Established CBP entry processes (including existing, applicable entry type(s) and paper or electronic submission) should be followed for de minimis value shipments where FDA has determined shipment information is necessary to make an admissibility determination. FDA prefers to have the information submitted electronically. For additional information regarding de minimis value shipments where FDA has determined notification is not necessary, please see CSMS #17-000388. |

|

Importers of de minimis shipments regulated under the FSIS must continue to file an import inspection application using the PGA message set or paper FSIS form 9540-1. |

|

|

Filers should continue to submit their Form 3-177 data and associated documents directly with FWS either electronically through eDecs or in paper. Filers should be prepared to supply a copy of the FWS clearance to CBP upon request. |

|

|

NHTSA regulated commodities are not eligible for the Section 321 exemption per 49 CFR 591. The NHTSA message set may be filed in ACE by codes DT1 and DT2. |

|

|

To accommodate and fulfill regulatory reporting requirements, an entry filing is required for all HTS products regardless of value. NMFS program requirements are designated per HTS codes "flagged" as NM1, NM2, NM3, NM4, NM5, NM6, NM7 and NM8 pursuant to the CBP ACE system. Specifics on filing under the four NMFS programs, 370, HMS, AMR and SIM can be found in the NMFS Implementation Guides for these programs. |

|

|

TTB-regulated commodities are not eligible for the Section 321 exemption per 19 CFR 10.153(e). The TTB Message Set may be filed in ACE as Entry Type 11 or 01. |

Chart 3 - PGA Policies Related to Returned American Goods & Household & Personal Effects

|

Agency (Department) |

PGA Policies |

|

US exports returned to the US can be exempt from AMS regulations provided: the Positive Lot Identification (PLI) is intact. The product must be in the original packaging and must establish that the quality was certified by AMS prior to leaving the US. If the previous conditions are not met then AMS treats the product as any other regulated imported product. |

|

|

No exemptions for returned American goods & household and personal effects. |

|

|

Lacey does not currently have data requirements for Returned American Good & Household and Personal Effects. |

|

|

There is an exemption for GCA firearms and ammunition if the importer can prove that they originally exported the product. This exemption does not apply to all other defense articles on the USMIL. |

|

|

No exemptions for returned American goods & household and personal effects. |

|

|

DOE OGC |

No exemptions for returned American goods & household and personal effects. |

|

No exemptions for returned American goods & household and personal effects. |

|

|

No exemptions for returned American goods & household and personal effects. |

|

|

No exemptions for returned American goods & household and personal effects. |

|

|

EPA TSCA |

No exemptions for returned American goods & household and personal effects. |

|

Returned American Goods: FDA will conduct general surveillance on American goods that are being returned; however, dependent on the product there may be additional guidance in a FDA Compliance Program Guidance Manual. Personal Effects: Because the amount of merchandise imported into the United States in personal shipments is normally small, both in size and value, comprehensive FDA coverage of these imports is normally not justified, however additional information regarding the coverage of personal importations is outlined in FDA's Regulatory Procedures Manual (RPM). FDA’s prior notice requirements must continue to be met on all food and feed shipments regardless of value or quantity. Unless otherwise exempt from the prior notice requirements for one of the indicated reasons under 21 CFR 1.277(b), there are no exemptions based on a de minimis value or quantity of food. |

|

|

FSIS does not consider returned American goods to be an import, therefore, no entry or exception is needed. |

|

|

No exemptions for returned American goods or personal effects, except: Certain shellfish and fishery products for human or animal consumption; Fish taken for recreational purposes in Canada or Mexico where a permit is not required under 50 C.F.R. Parts 16, 17, or 23;Wildlife products or manufactured articles that are not intended for commercial use and are part of a shipment of household effects of persons moving their residence to the U.S. and when such items do not require a permit under 50 C.F.R. Parts 16, 17, 18, 21, and 23 and when such items are not raw or dressed furs or raw, salted, crushed hides or skins; Only recognizes effects (except at identified above) when such effects are in personal accompanying baggage, not cargo; or No exemption to declaration or clearance for returning goods. |

|

|

No exemptions for returned American goods & household and personal effects. |

|

|

No exemptions for returned American goods & household and personal effects. |

|

|

The TTB Message Set is required for TTB-regulated commodities imported under 9801.00.80. |

This guidance document was developed by the Border Interagency Executive Council (BIEC), an interagency working group formally established by Executive Order 13659. The BIEC serves as an Executive Advisory Board and decision making body charged with enhancing coordination across federal customs, transport security, health and safety, sanitary, conservation, trade, and phytosanitary agencies with border management authorities and responsibilities to measurably improve supply chain processes and the identification of illicit and non-compliant shipments. BIEC membership includes senior leadership from agencies that provide approval before goods can be imported and exported, including the Departments of State, Treasury, Defense, Interior, Agriculture, Commerce, Health and Human Services, Transportation, Homeland Security, the Environmental Protection Agency and the Consumer Product Safety Commission, as well as representatives from the Executive Office of the President.

Subscribe for the latest updates

Subscribe Here!

By submitting this you will be receiving our latest updates on post.

- Recent

- Popular

.svg)

.svg)

.svg)

.svg)

Comments

Comment Form